- Giáo dục

- Chiến lược Giao dịch

- Chiến lược Cây Nến Squat

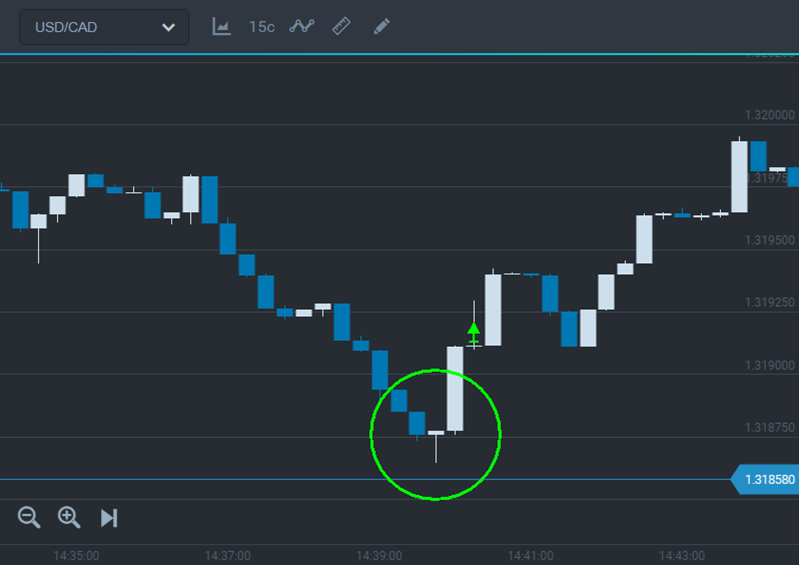

Squat Candlestick Strategy

Squat candlesticks often indicate a potential reversal in market trends. Typically, they suggest uncertainty about the current market direction, and they are commonly observed at specific price levels. These squat candlesticks, characterized by a small body and a long shade, may appear singly or in multiples. If you encounter a candlestick with these features, be vigilant as it could signal an impending reversal in the current trend.

What to do after you see this signal:

1) If you see a squat candlestick has appeared be prepared to open a deal.

2) A squat candlestick is followed by a new reversal candlestick.

3) After closing a new candlestick open a deal in its direction.

Buying a call after a squat candlestick

If you see a trend continuation following the appearance of a squat candlestick, it's best to consider the signal canceled. Similarly, in the case of an engulfing pattern, it's essential to wait for the closing of a new candlestick after the squat one to confirm a reversal.

Keep in mind that consecutive squat candlesticks may indicate market uncertainty. For a deeper understanding, explore various squat candlestick patterns through books on candlestick analysis.